Today was a doozy. I’m sure those of you who watch the markets closely are aware of today’s rout, and some of you might be panicking. For those who don’t check their portfolio regularly: good for you, you missed a harrowing experience.

Hideous Day

Today the S&P 500 index lost 3.56%, and the Nasdaq fell 4.99%. Personally, I’m down 6.02% for the day, as I hold substantial exposure to several businesses which were beat up even worse: Shopify (SHOP) in particular dropped nearly 15% today on a bad quarterly earnings report on top of the broader ugliness.

Not the Worst

But in fact, today was far from one of the worst. On October 19th, 1987— the infamous “Black Monday” crash— the S&P 500 index fell 20.47%. And as recently as March 16, 2020, it fell 12%. I was in the red that day by 12.45%, absolutely brutal and the sort of day that scares every investor. I was shaken. But I didn’t sell. I gatheredmy courage (there may have been whiskey), and leaned into my experience and my investing heroes. By the end of 2020, my portfolio had rocketed back up, and I had by far the best year of my career. If— like most ‘mom-and-pop’ investors who watch the market too closely— if I had sold that day in a panic, I wouldn’t have known when to start buying again, and I would have missed out entirely.

What Matters

Because really, it’s not what happens in the market day to day that matters. It’s how you respond. An investor who panic-sells into a falling market is no different than one who FOMO buys into a rising market: that is market timing. And as I’ve said here before, over the long run a market timer will always lose.

Be Like Buffett

“Be fearful when others are greedy. Be greedy when others are fearful.” — Warren Buffett

Today was a day of fear. Today Wall Street feared raging inflation, a Federal Reserve crackdown which could launch a recession, Covid factory closures in China, a supply chain still not close to normalized, oil supply constraints due to Russia’s invasion and even the possibility of a nuclear. Yesterday I read the argument that a Supreme Court repeal of Roe v Wade will over time reduce women in the workforce, thereby constraining US productivity and economic growth. A lot to be afraid of, so not a surprise when we see a rout like we did today. What to do? Be greedy: Buy. Prices for many outstanding businesses are at a 2- year low point, and values are everywhere. This can’t go on forever. Soon some big-deal pension fund or mutual fund manager will decide it’s time to get back in, and that will drive a surge which will catch on. There will be a single day not long from now when the markets will rise 5%. And even if you buy into a business which falls some more before it turns, at these prices you probably still got a steal.

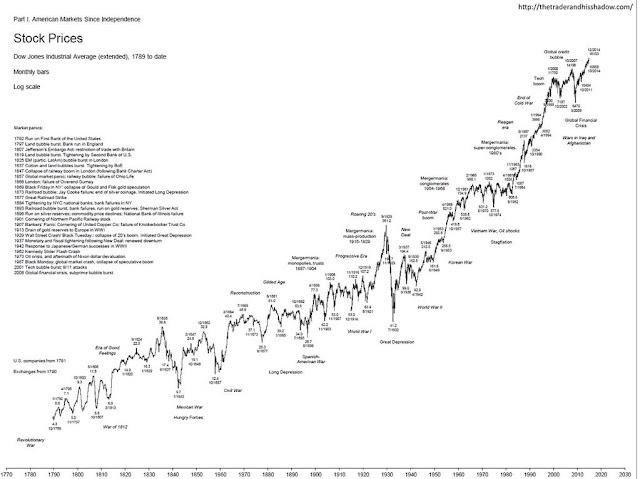

Days like today are a test. It’s the big roller coaster plummet: are you sure you have the stomach for this? Do you believe in capitalism, and in the American economy over the long haul? Here’s a proxy for the stock market, 1789-2014:

That massive long-term upward trajectory, with all its brief jags and drops— that’s the path we’re on. Stay on the path.