I am always talking in here about why it's so important to think long-long term, and to avoid selling into fear or panic. About holding your positions through the inevitable down cycles. About having the stomach for the nausea-inducing roller coaster of modern stock investing.

So here, speaking clearly to that point, is a wonderful blog post by one of my favorite go-to analyst/advisors, Ben Carlson of Ritholz Wealth Management. Enjoy.

Robin

https://awealthofcommonsense.com/2023/06/this-is-why-you-stay-the-course/

This is Why You Stay the Course

Posted by

Last year was one of the worst years ever for financial markets.

Call it recency or loss aversion or some other Daniel Kahneman bias but for some reason, our brains are hard-wired to assume big losses will be followed by additional losses (just like we assume big gains will be followed by additional gains).1

The thing about big losses in the stock market is sometimes they are followed by big losses…but sometimes they’re followed by big gains.

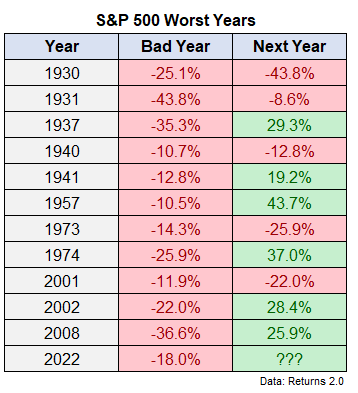

Just look at every double-digit down year for the S&P 500 going back to 1928 along with the ensuing returns in the following year:

Historically after a bad year you’re looking at feast or famine. You either got a huge rally or further soul-crushing losses.

It was not a foregone conclusion that stocks would rally this year as much as they have — the S&P 500 is up almost 14% while the Nasdaq 100 has gained nearly 27% this year. It could have gotten worse if inflation stayed high or the Fed broke something or we went into a recession or some other risk came out of left field.

Regardless of the outcome, this is a good lesson in the power of staying the course as an investor. And I believe staying the course was the right move whether stocks cratered even more or took off like a rocket ship.

Why?

What’s the alternative? Guess what will happen next? Good luck with that.

Even the pros have no idea what will happen next in the market.

Heading into the year, Sam Ro published a list of S&P 500 year-end price targets from 16 of the biggest Wall Street firms:

The S&P 500 ended 2022 at around 3,840 so there were a handful of strategists who expected mild losses in 2023 while most were expecting mild gains.

It makes sense that Wall Street was tepid coming into the year considering the stock market fell almost 20% in 2022.

We’re only halfway through the year so it’s still a little early to offer a full report card for these predictions but the stock market has outperformed expectations based on where we sit today.

As of this writing the S&P 500 is trading at roughly 4,370.

So the stock market has already gone up more than any of these strategists, save for Deutsche Bank, predicted for the whole year.

But they’re not waiting around to see if those original forecasts could come true. Now that stocks are up double-digits for the year many Wall Street strategists are revising their forecasts higher.

Wall Street strategists get pessimistic when stocks are falling and optimistic when stocks are rising. I don’t share this with you to poke fun at Wall Street.

The point of this exercise is to prove how difficult it is to make predictions about the future, especially as it relates to short-term movements in the stock market.

When stocks fall, our emotions make us think they will fall even further. And when stock rise, our emotions make us believe they are going to rise even more.

This is why I’m such a big proponent of having an investment plan that you can stick with through a wide range of market and economic environments.

Staying the course means going against your own emotions at times.

Staying the course means thinking and acting for the long term even when it doesn’t feel right in the short-term.

Staying the course means preparing not predicting.

Staying the course means doing nothing when that’s what your plan calls for.

Unfortunately, doing nothing is hard work because markets are constantly tempting you to make changes to your portfolio.

There’s an old parable about a locksmith who had a tough time picking locks when he was just a lowly apprentice learning on the job. He would have to use all sorts of tools and it took him a long time to open doors when people locked themselves out of their cars or homes. But people saw him sweating it out and the effort was evident so they tipped him quite well.

But as he slowly but surely learned the tricks of the trade he was able to pick locks quicker which much less effort. The problem is his tips went down because he got people into their vehicles or houses much faster. He made it look too easy.

There is a good investing lesson in this story.

Intelligent investors realize effort is often inversely related to results in the market. Just because you do more or try harder doesn’t guarantee better results. In fact, doing more is more often than not damaging to your investment performance.

Doing less or doing nothing at all most of the time is the right way forward for the majority of investors.

This is why you stay the course.

Further Reading:

2022 Was One of the Worst Years Ever For Markets

1This is not all of us, of course. There are always going to be contrarians who go against the grain.