It certainly is a strange time to be an investor in the public markets. There is a lot going on, and much of that is fairly unprecedented, so its impact on the market is likewise difficult to predict.

What I Know

We are probably already in a recession, though it’s a strange one. We’re seeing strong corporate profits and a tight labor market. We have unusually flush consumers— thanks to pandemic economic stimulus— but they’re spending more on experiences like travel and dining out than they are on cars and clothing, and their collective debt is breaking records. We’ve got inflation, rising interest rates, collapsing banks. We are fighting a proxy war against Russia via Ukraine. We have ongoing diplomatic mayhem with China. There are the culture wars and the now normal political division and resulting semi-paralysis of Congress. Plus a Supreme Court potentially in moral decline, raging climate change, the long tail of Covid-19, and an impending election contest shaping up to be between the two oldest and whitest men ever to run for the job. Net result: a lot more uncertainty and huge volatility.

The stock market is having a better time in 2023 than it did in 2022, but that’s mostly a result of massive AI (or AI-adjacent) companies and their collective impact on the markets. Many of those businesses are the ‘big tech’ firms you always hear about, so their performance has outsize impact on the returns of the broader market— the Nasdaq, the S&P 500, Russell 2000, etc. They’re carrying everyone’s water. If your portfolio is up this year, it’s likely because you own a couple of those individual companies, or you own comprehensive stock indexes.

All of which means that a huge number of the individual businesses you or I might own stock in are still seeing their share prices down from 2020 as a result of the big pullbacks in late 2021 and throughout 2022.

It also means that if you’re a stock picker like I am, your job is harder. You can’t simply choose businesses that have enormous market share or are promising an exciting new product or are flush with cash or have brought in talented new management. The businesses you choose also have to be able to thrive and grow in this market, and I for one have no idea how to see what’s coming next— never mind how that thing will affect my companies.

It also means that if you’re a stock picker like I am, your job is harder. You can’t simply choose businesses that have enormous market share or are promising an exciting new product or are flush with cash or have brought in talented new management. The businesses you choose also have to be able to thrive and grow in this market, and I for one have no idea how to see what’s coming next— never mind how that thing will affect my companies.

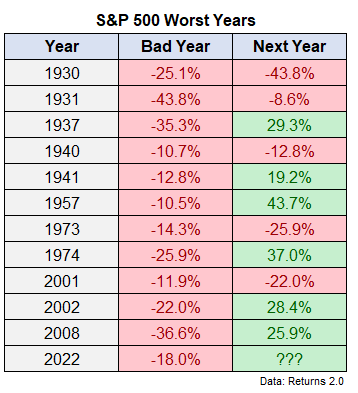

Things may not get better from here; it is entirely possible we have not seen the bottom of the stock market yet. The 2020 stock market launched a scary and speedy fall at the same moment that Covid froze the economy. Everything stopped— work, school, bars and restaurants, travel, gyms, shopping. But in spite of the pandemic, markets bounced back quickly and went on to have a shockingly good year, showing sizable gains in many areas. Manufacturing and fulfillment (packaging and shipping millions upon millions of orders around the world) began to sputter late in 2020, and 2021 was a mixed bag. And as I said previously, 2022 was pretty awful for investors. Then 2023 opened with big spikes in oversold tech stocks, then spiked again, with ugly volatility, around AI. But with all the economic, political, legal and climate uncertainty, no one knows for sure what comes next. Ten minutes on the internet will introduce you to dozens of theories and warnings. Believe none of them.

Nevertheless, there are also glimmers of light in the markets. As I mentioned above, the shares of a great number of excellent businesses remain below their 2-year high water mark. Even if we assume things got a little heady in those mid-2020 pandemic days and knock 20% off their then-value, plenty of companies look ready to climb again. Recession or no, there doesn’t appear to be anything structurally wrong with these businesses. So even if the overall market falls in the next 12 months, in theory these will do well in the longer term.

Nevertheless, there are also glimmers of light in the markets. As I mentioned above, the shares of a great number of excellent businesses remain below their 2-year high water mark. Even if we assume things got a little heady in those mid-2020 pandemic days and knock 20% off their then-value, plenty of companies look ready to climb again. Recession or no, there doesn’t appear to be anything structurally wrong with these businesses. So even if the overall market falls in the next 12 months, in theory these will do well in the longer term.

What I Don’t Know

Where are those glimmers? 100 stock analysts will give you 85 answers to what’s the next big growth story, or where the value is now. (10 will say It’s all about AI now and 5 will say The whole thing’s going to crap! Sell!)

How long will it take for the market overall to recover? The short and unhelpful answer is, I don’t make projections of duration or price at all, ever— I’m terrible at it. The only slightly more helpful answer is it will depend on which corner of the market you’re talking about, what will happen with all those external-event unknowns. Some industries and businesses are already returning to normal, or better than normal, like travel, but many of those companies’ stock prices do not yet reflect that resurgence— most likely because investors are cautious and what they expect from the companies they buy has changed.

How impactful will the pandemic-era ‘meme-stock’ trend be going forward? If you’ve been paying attention, you’ll know that multiple unlikely companies saw shocking share price rallies in the middle of the pandemic shutdowns. AMC Entertainment theaters, GameStop video game stores, Bed Bath and Beyond homewares stores (now in bankruptcy) and others all saw crazy price gains over the span of a few days for no obvious reason. Hertz car rental declared bankruptcy during the travel stoppage, and then its share price surged wildly. Ultimately it was a social-media driven movement of individuals who coordinated efforts to move a stock price. Gambling resulting from pandemic boredom? My hope is that the trend will wither as our lives re-normalize. However, multiple analyses now suggest that the recent collapses of Silicon Valley Bank and First Republic Bank, among others, is a result of a related— if reversed—dynamic. The possibility exists that the potential virality of social media has fundamentally changed some of the reasons markets move, and the suddenness with which they do it.

What I want to end with is some specific takes on my own investing direction of late. I won’t call them recommendations because I lack the official certification to do that and stay out of hot water. But here are some things I’m thinking about:

Nvidia is too hot. While I ‘m a fan of this chipmaker and have very much enjoyed its recent success, I also believe AI has become its own sort of mini-bubble. Nvidia is the poster child of the movement and is now way too expensive. I have already sold down about 15% of my holdings and will likely do so again if it continues its rampage.

AirBnb will begin to surge post-summer. Above I mentioned companies that are seeing a lot of business but whose share prices do not reflect that; AirBnb is a perfect example. I can’t see the growth of the travel industry taking place without this rental platform front and center. AirBnb now has more available rentals worldwide than all the rooms of several of the major hoteliers combined, with homier feel (Kitchens! Sitting rooms!), a lower consumer cost per square foot and— as they do not own their properties— a vastly less expensive business model.

AirBnb will begin to surge post-summer. Above I mentioned companies that are seeing a lot of business but whose share prices do not reflect that; AirBnb is a perfect example. I can’t see the growth of the travel industry taking place without this rental platform front and center. AirBnb now has more available rentals worldwide than all the rooms of several of the major hoteliers combined, with homier feel (Kitchens! Sitting rooms!), a lower consumer cost per square foot and— as they do not own their properties— a vastly less expensive business model.

Shopify is the biggest online selling platform after Amazon. But again the stock price does not reflect the size or scope of this business. If you’ve ever bought something online from a ‘direct-to-consumer‘ (D2C) business, based on a recommendation from a friend or resulting from an ad on social media, you’ve probably done it through a website and payment process provided via Shopify. And if you’re a new business owner looking for a place to host your goods on the internet, Shopify is your first stop.

Moderna will change the way we treat disease. This pandemic darling has seen wild share price swings in sync with the up and down level of demand (presold) for vaccinations. It might take time for markets to realize the potential of the company’s patented mRNA based vaccines, maybe even several years. But it will change medicine and that will ultimately be reflected in the price.

JP Morgan Chase will continue to grow as it cleans up the mess that’s become of regional banking. The company is led by Jamie Dimon, a man so expert and so respected in financial circles that he’s often the first call for CEOs, members of Congress, Treasury officials, and presidents. JP Morgan is the literal definition of ‘too big to fail’, and it’s going to keep getting bigger— and richer.

JP Morgan Chase will continue to grow as it cleans up the mess that’s become of regional banking. The company is led by Jamie Dimon, a man so expert and so respected in financial circles that he’s often the first call for CEOs, members of Congress, Treasury officials, and presidents. JP Morgan is the literal definition of ‘too big to fail’, and it’s going to keep getting bigger— and richer.

Disney is totally mispriced. Disney’s share price has become too much a factor of its unprofitable streaming service, rather than its much larger sister businesses. Investors mistakenly believe Disney’s primary corporate competition comes from Netflix and Warner-Discovery, who operate entirely in a much narrower industry. It may be some time before the market remembers that the future of this company is not about its losses from streaming but about profits from Disney World guests, Disney (+ Marvel + Star Wars) movie fans and Disney Cruise passengers.

Thanks for reading! Also thank you for your belief that I’m worthy of your valuable time.

As always, email with questions or ideas you want to kick around. I never tire of examining this stuff from different angles. And share this article with a friend.

Robin Rifkin

Zaga Investment Co

June 2023